FAQ: Health insurance plans

Jump to:

Types of health insurance plans

HMO stands for health maintenance organization. An HMO is a type of health plan that requires you to select a family doctor, often called a primary care physician or PCP. You need a referral from your PCP to see a specialist in the HMO network, such as a cardiologist (heart doctor). Typically, only emergency services are covered if you go outside the health plan network. Learn more about the HMO plans offered by Independence Blue Cross and how they work.

PPO stands for preferred provider organization. A PPO is a type of health plan that allows members to see providers in and out of the network. You pay lower costs when you see network providers. But you can go outside the network and pay more for your services.

To learn more about PPOs, read our article “What is a PPO?”

Learn more about the PPO plans offered by Independence Blue Cross and how they work.

In an HMO, you choose a family doctor, called a primary care physician (PCP), who provides the services you need. Your PCP refers you to other doctors or health care providers within the HMO network when you need specialized care. Typically, only emergency services are covered if you go outside of the plan network. HMOs usually have the lowest premiums.

In a PPO, you don’t have to choose a primary care physician (PCP), and you can go to doctors in or out of the health plan’s network. You can see doctors, hospitals, and other health care providers of your choice, such as a heart doctor, but you will pay more if your doctor does not participate in your health plan’s network. PPOs tend to have higher premiums than HMOs.

For a more in-depth analysis, read “HMO vs. PPO”.

You can use the Independence Blue Cross plan comparison tool to find a health plan that best matches your needs, view your lowest cost plan, and/or a plan that is most popular for individuals like you.

EPO stands for exclusive provider organization. These health plans combine the flexibility of PPO plans with the cost-savings of HMO plans. They offer in-network coverage only, but don’t require you to select a primary care physician (PCP) or get referrals. EPO plans don’t cover out-of-network care unless it’s an emergency.

To learn more about EPOs, read our article “What is an EPO?”

A POS plan combines elements of an HMO and a PPO. As with an HMO, you will need to select a primary care physician. But like a PPO, you can receive medical care from both in- and out-of-network providers. You’ll pay less when you get a referral to an in-network doctor or hospital, and more if you choose an out-of-network doctor or hospital.

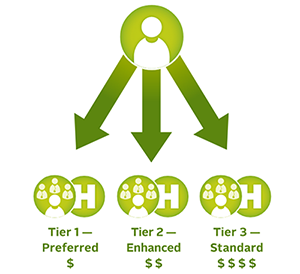

In a tiered network plan, the network of doctors and hospitals is divided into groups called “tiers” based on cost and quality measures. You can save on your out-of-pocket costs by choosing the lowest-cost tier, but you always have the option to choose providers in the other tiers (you’ll just pay more). For example, you may pay only a $15 copay to see a doctor in Tier 1, $30 for a doctor in Tier 2, or $50 for a doctor in Tier 3. This type of plan may be a good option if your doctors and hospitals are already in the lowest-cost tier, or if you don’t mind switching providers to save money.

CDHPs are becoming more popular because they give people control over how their health care dollars are spent. A CDHP generally pairs high deductibles with low premiums and a spending account to help you set aside money for health expenses. There are several different types of spending accounts available, such as health savings accounts (HSAs), health reimbursement accounts (HRAs), and flexible spending accounts (FSAs).

An HSA lets you save money for qualified medical expenses, tax-free. You don’t pay taxes on the money you put in, the money you take out (for qualified medical expenses), or any money you earn on the account. The IRS determines what qualifies as a qualified medical expense, which includes your out-of-pocket costs (copays, deductibles, coinsurance), along with some services not covered by a health plan, such as Lasik surgery. Insurers can only offer an HSA with a special type of high deductible health plan which meets guidelines set by the IRS. With an HSA, you own the account even if you change to a different type of health insurance plan or change jobs.

Keystone HMO Proactive health plans

Keystone HMO Proactive works just like a typical HMO in that you can visit any doctors and hospitals in the network, and you select a primary care physician (PCP) who refers you to specialists. With a tiered network, you can save on your out-of-pocket costs when you visit certain health care providers.

All Keystone Health Plan East HMO providers have been grouped into three tiers based on cost and, in some cases, quality measures. While all of the doctors and hospitals in our network must meet high quality standards, some are able to offer more cost-effective care. If they cost less, then you’ll pay less. It’s that simple. You can check what tier a doctor is in by searching for them in our Find a Doctor tool and selecting “Keystone HMO Proactive” in the plan drop-down menu.

- Tier 1 – Preferred: Members pay the lowest cost-sharing for most services.

- Tier 2 – Enhanced: Members pay a higher cost-sharing for most services compared to Tier 1 – Preferred.

- Tier 3 – Standard: Members pay the highest cost-sharing for most services.

With an HMO tiered network plan, the network is divided into three groups that we call tiers. All three tiers have high-quality doctors and hospitals. But don’t think that high quality has to equal high cost. These tiers help you choose providers that offer you the best value on care. Our HMO tiered network plans are called Keystone HMO Proactive and give you access to the full HMO network of more than 49,000 doctors and 180 hospitals, unlike a limited network that gives you access to a smaller portion of a network.

Yes. Many covered services will cost you the same amount no matter the tier level of the provider or facility you choose. These are:

- Preventive care

- Emergency room

- Emergency ambulance

- Urgent care

- Prescription drugs

- Pediatric dental and vision

- Behavioral health

- Transplants

- Spinal manipulation

- Outpatient lab/pathology1

- Routine radiology/diagnostic1

- MRI/MRA, CT/CTA scan, PET scan1

- Physical/occupational therapies1

Emergency room fees are the same no matter which tier of hospital you choose. However, if you are admitted to an in-network hospital from the emergency room, the cost-sharing for your inpatient hospital care will apply based on the tier of the in-network hospital. If you are admitted to an out-of-network hospital following an emergency room admission, the Tier 3 – Standard level of benefits will apply. For non-emergency care, you must use in-network providers.

The Keystone HMO Proactive plans still include the full Keystone Health Plan East HMO network of providers. However, with our Proactive plans, doctors, hospitals, and other types of providers in the Keystone Health Plan East HMO network have been assigned to one of three benefit tiers. For most services, you can save money when you visit providers in lower tiers.

There are some services, such as preventive care and emergency room, physical therapy, occupational therapy, and mental health, which have the same cost-sharing regardless of the provider’s assigned tier.

Keystone HMO Proactive plans are ideal if you’re looking for a more affordable plan. They tend to have lower monthly premiums, plus they give you an opportunity to save even more on your cost-sharing by visiting providers in Tier 1 – Preferred. When you choose a Keystone HMO Proactive plan, you don’t have to stick with just one tier. You can choose Tier 1 – Preferred providers for some services and providers from Tier 2 – Enhanced or Tier 3 – Standard for other services. The choice is yours each time you receive care. You can check the tiers of your current doctors and providers using our Find a Doctor tool.

Yes, all doctors, hospitals, and other health care providers from the Keystone Health Plan East HMO network are assigned a tier; however, there are some services that have the same cost-sharing across all tiers. Examples include preventive care, emergency room, physical therapy, occupational therapy, and mental health. Refer to the summary of benefits for more details.

No. There are some services that have the same cost-sharing across all tiers. Examples include preventive care, emergency room, physical therapy, occupational therapy, and mental health. Only certain provider types will have cost-sharing that varies based on the tier assignment. Refer to the summary of benefits for more details.

We assign our HMO network providers to one of three tiers on an annual basis. These tier assignments are based on relative cost, quality (if available) and the tier of the facilities in which your PCP typically refers Independence Blue Cross patients for hospital and outpatient surgical services. While all of the doctors in our network must meet high quality standards, many offer the same services at a lower cost.

More than 50 percent of doctors and hospitals are in Tier 1 – Preferred, so you have plenty of choices on where you receive care. And you don’t have to stay within one tier. For example, you can choose to see Tier 2 – Enhanced providers for some services and Tier 3 – Standard providers for other services.

Independence Blue Cross re-evaluates its tier assignments annually, and tier assignments are effective January 1.

You can see all of the Keystone Health Plan East HMO network hospitals arranged by tier and county by viewing the Tiered Network Hospital List. You can also see which tiers your doctors and hospitals are assigned by using our Find a Doctor tool.

Yes. You can speak with your doctor about why he or she chose the specialist. You can explain to your doctor that you have a tiered network plan and that you prefer to see a Tier 1 – Preferred specialist if possible.

No. If you have an emergency, you should visit the nearest hospital. Emergency room services, in addition to a few other services, have the same cost-sharing across all tiers. Please note that if you are admitted to an in-network hospital from the emergency room, the cost-sharing for inpatient hospital care will apply based on the tier of the in-network hospital. If you are admitted to an out-of-network hospital following an emergency room admission, the Tier 3 – Standard level of benefits (highest cost-sharing) will apply.

Yes, since tiers are assigned by office location, rather than by individual doctor. For example, Dr. Smith’s office in the city may be assigned to Tier 1 – Preferred while the office in the suburbs may be assigned Tier 2 – Enhanced. What you pay when you see Dr. Smith will be based on the tier of the office you visit for your appointment. This tier assignment will be displayed in our Find a Doctor tool.

You can contact a customer service representative for Keystone HMO Proactive related-inquiries by calling 1-844-BLUE-4ME (1-844-258-3463, TTY: 711).

Keystone HMO health plans

HMO stands for health maintenance organization. An HMO is a type of health plan that requires you to select a family doctor, often called a primary care physician or PCP. You need a referral from your PCP to see a specialist in the HMO network, such as a cardiologist (heart doctor). Typically, only emergency services are covered if you go outside the HMO’s network of participating providers. You do not have the option to see out-of-network providers when you have an HMO.

With a Keystone Health Plan East HMO from Independence Blue Cross, you can see any doctor or visit any hospital in the Keystone Health Plan East network. You pick a primary care physician (PCP), or family doctor, to coordinate your care. Your PCP will treat you for general health needs and refer you to specialists as needed.

There are five Independence Blue Cross Keystone HMO health plans that allow you to save money when you choose health care providers within the Keystone Health Plan East network.

Compare coverage details on costs and coverage for Keystone HMO plans and see if one of these coverage health plans is best for you:

- Keystone HMO Gold

- Keystone HMO Gold Classic1

- Keystone HMO Silver Classic

- Keystone HMO Silver Basic

- Keystone HMO Bronze

Please note that Keystone HMO Gold Classic and Keystone HMO Silver Basic are only available for purchase through Pennie.

You will not be covered for care that you receive from doctors or hospitals outside the Keystone Health Plan East providers’ network. If you are considering enrolling in a Keystone HMO, be sure to check that your preferred providers are in the Keystone Health Plan East network.

If you have an emergency, you should visit the nearest hospital. Emergency services from out-of-network providers will be covered.

You can contact a customer service representative for Keystone HMO related-inquiries by calling 1-844-BLUE-4ME (1-844-258-3463, TTY: 711).

Personal Choice PPO health plans

PPO stands for preferred provider organization. A PPO is a type of health plan that allows members to see providers in and out of the network. You pay lower costs when you see in-network providers. But you are also free to go outside of the network and pay more for your services.

Visit “What is a PPO?” to learn more about PPOs.

With a Personal Choice PPO plan from Independence Blue Cross, you can choose to see any doctor or visit any hospital you choose. You will also enjoy in-network coverage anywhere in the United States when you use providers who participate in the BlueCard® PPO network. Learn more about Personal Choice PPO plans.

No. You don’t need to get referrals with a Personal Choice PPO plan, so you can see any specialist you want without needing permission from a primary care physician (PCP), or family doctor.

A PPO plan allows you to receive care from any provider, either in- or out-of-network, without a referral.

There are six Independence Blue Cross Personal Choice PPO health plans that offer the flexibility to choose the health care providers you want and the coverage you need.

Compare details on costs and coverage for Personal Choice PPO plans and see if one of these plans is best for you.

- Personal Choice PPO Gold

- Personal Choice PPO Gold Classic

- Personal Choice PPO Gold Preferred

- Personal Choice PPO Silver Classic

- Personal Choice PPO Silver Basic

- Personal Choice PPO Bronze

You can contact a customer service representative for Personal Choice PPO related-inquiries by calling 1-844-BLUE-4ME (1-844-258-3463, TTY: 711).

Personal Choice EPO health plans

EPO stands for exclusive provider organization. An EPO is a type of health plan in which you pay lower costs when you see in-network providers. But you are also free to go outside of the network and pay more for your services.

No. You don’t need to get referrals with a Personal Choice EPO plan, so you can see any specialist you want without needing permission from a primary care physician (PCP), or family doctor.

An EPO plan does not offer out-of-network coverage. But you are free to see doctors outside of the network and pay more for your services.

There are three Independence Blue Cross Personal Choice EPO health plans that offer the flexibility to choose the in-network health care providers you want without needing a referral.

Compare details on costs and coverage for Personal Choice EPO plans and see if one of these plans is best for you.

- Personal Choice EPO Bronze Classic

- Personal Choice EPO Bronze Reserve

- Personal Choice EPO Bronze Basic

You can contact a customer service representative for Personal Choice EPO related-inquiries by calling 1-844-BLUE-4ME (1-844-258-3463, TTY: 711).

Health Savings Accounts (HSA)

A Health Savings Account (HSA) is a tax-advantaged savings account that can be used to save for health care expenses. You must be enrolled in an HSA-qualified high-deductible health plan to be eligible to open an HSA. You don’t pay taxes on the money you put in, the money you take out for qualified medical expenses, or any money you earn on the account. Qualified medical expenses include your out-of-pocket costs (copays, deductibles, coinsurance) along with some health care services not covered by a health plan, such as LASIK surgery. There is a maximum amount that you can contribute to an HSA each year; however, if you don’t use all of the money within your benefit period, it rolls over to the next year. (See IRS publication 969 for more information about HSAs.)

A QHDHP is a health insurance plan with a minimum deductible of $1,650 (for self-only coverage) or $3,300 (for family coverage).2 The annual out-of-pocket cost (including deductibles and copays) cannot exceed $8,300 (for self-only coverage) or $16,600 (for family coverage).2 HDHPs have first-dollar coverage or no deductible for preventive care and higher out-of-pocket costs (copays and coinsurance) for out-of-network services.

An HSA can allow you to:

- Use the money you save to make tax-deductible HSA contributions

- Take tax-free withdrawals to pay for qualified medical expenses

- Save for future health care expenses

It’s easy to get started with your HSA. If you open your HSA through Independence Blue Cross, you can easily access your account, view your activity, and even pay in-network providers by logging in to ibx.com. You also have the option to set up an HSA with another vendor.

Once you get your HSA set up and your information has been processed, you will receive a welcome kit and a separate HSA debit card in the mail.

Yes, there are limits on the amount that you may contribute to an HSA. These limits are set by the federal government and are generally updated each year under their Health Savings Account rules and guidelines.

For 2025, HSA contribution limits are:

- $4,300 for individual coverage

- $8,550 for family coverage

- $1,000 in additional catch-up contributions for individuals ages 55 and older

The contribution limits include all contributions made on behalf of the individual (including contributions made by an employee, an employer, a self-employed person, or a family member). If you have more than one HSA, the annual contribution limit applies to the total of all HSAs. You can decide how to contribute to your HSA (one time or multiple times throughout the year) as long as you don’t exceed the maximum allowable annual contribution.

Please refer to this web page for more information about HSAs. If you have any questions or concerns about your HSA or questions about Health Savings Account rules, please call Member Services using the phone number provided on the back of your Independence Blue Cross ID card.

1 When you receive services at a designated site referred by your primary care doctor

2 These amounts are for 2025 and are adjusted annually.